About

Founded in 2017, we offer investment and mortgage services. We focus on secure investments through low risk mortgages in the Greater Toronto Area. Our strict guidelines ensure stable, long-term returns for our investors.

Vision

Our vision is to become the pillar of financial empowerment, where determined investors attain unparalleled stability and success and individuals fulfill their dream of homeownership.

Values

Quality - through the continued work ethic and innovative spirit of our team

Commitment - by delivering excellence, trust, and integrity to our clients

Accountability - by upholding our responsibility to deliver our vision to the public, with our time, talent, and resources in the industry

Our Team

Patrick Lam

Chief Executive Officer

Marshall Liang

Chief Operating Officer

Michael Xia

Chief Investment Officer

Vivian Chan

Financial Controller

Carleigh Jenkins

Executive Assistant

Lawrence Chan

Managing Partner

Winnie Chan

Administration Officer

Tina Zhou

Investment Administrative Officer

Sarah Wang

Administrative Assistant

Investments

HRU Preferred SIF C-1

+Bonus

Targeted Annual Yield

Blended Commercial

HRU Preferred SIF B-1

+Bonus

Targeted Annual Yield

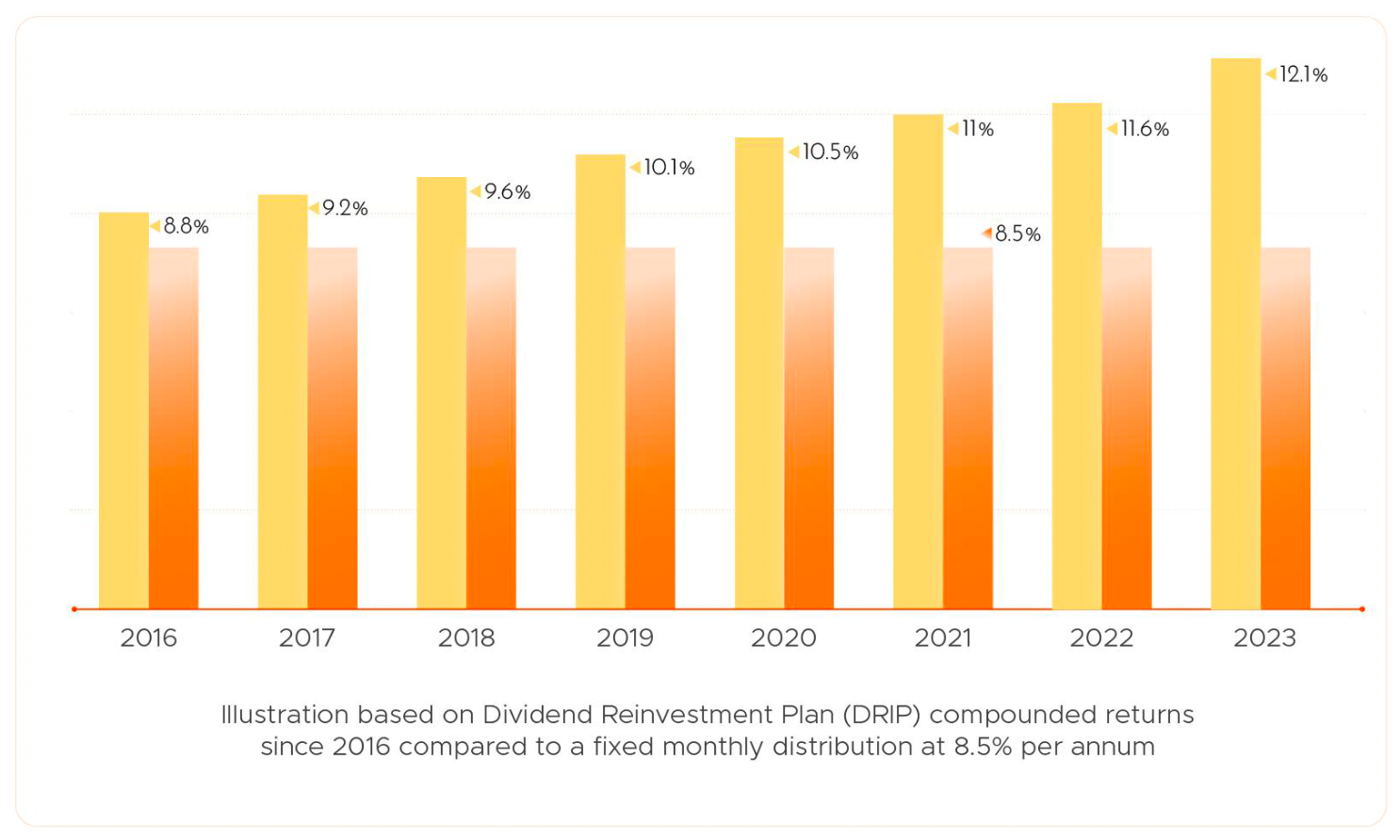

- Compounded (DRIP) or monthly dividends

- Investment Plans: Cash, RESP, RRSP, RRIF, TFSA

- Secured through Real Estate debt

How It Works

A Mortgage Investment Corporation (MIC) is a specialized Canadian investment in a diverse pool of managed mortgages. MIC shares qualify under the Income Tax Act (Canada) and can be held in registered tax accounts like RRSPs, RRIFs, TFSAs, RESPs, as well as in Cash. Profits are distributed to investors based on their share, with mortgages secured by real properties and additional security.

1.

Investment

Investor money placed in MIC

2.

Mortgages

MIC offers short terms mortgages

4.

Dividend

MIC distributes profits back to investors

3.

Interest Payment

Mortgage Payments flow back to MIC

2.

Mortgages

MIC offers short terms mortgages

3.

Interest Payment

Mortgage Payments flow back to MIC

4.

Dividend

MIC distributes profits back to investors

We Lend Just For You

Mortgages Up to

0%

for detached, semi-detached houses & townhomes

Up to

0%

for high-rise condos

Mortgages

Why Borrow from HRU

Custom Terms

Choose from 15 days to 12 months, with options for open, closed, or mixed terms.

Flexible Payment Methods

Prepayment, partial payments, or full payments.

Interest Only

Calculated based on the outstanding balance each day.

Client-Centered Approach

Tailored solutions to meet individual needs, with transparency and support.

We Specialize in Non Standard Mortgages

For Customer Service

Trust Companies

We partner with Olympia Trust (#70987654641) and Odyssey Trust as the unbiased Trust Administrators and Trustees for HRU clients' Registered accounts. These trusts assist by securely holding investor funds and securities, processing investment transactions, ensuring investment compliance, issuing tax documentation, and maintaining records.

Income Tax Act

To maintain our status as a Mortgage Investment Corporation (MIC), we must comply with strict regulations outlined in the Canadian Income Tax Act (subsection 130.1[6]).

Our Clients

My friend recommended me to HRU in 2017, and I continue to invest with them. They are safe, reliable and professional, and the return on investment is better than banks!

Arthur Blanc

I am a Broker and own a Mortgage Brokerage. Risk Mitigation is one of my top priorities. HRU MIC is a platform that allows investors to invest and borrow with confidence and assurance.

Jessica Miller

My friend recommended me to HRU in 2017, and I continue to invest with them. They are safe, reliable and professional, and the return on investment is better than banks!

Arthur Blanc

I am a Broker and own a Mortgage Brokerage. Risk Mitigation is one of my top priorities. HRU MIC is a platform that allows investors to invest and borrow with confidence and assurance.

Jessica Miller

Frequently asked questions

A Mortgage Investment Corporation (MIC) serves as a vehicle for pooling investor funds to provide short-to-medium-term financing, typically ranging from 6 to 36 months, secured by real estate assets. The revenue generated from interest and fees paid by borrowers, after deducting operating expenses, is distributed to investors in proportion to their investment.

Given the prevailing low-interest-rate environment, investors seeking enhanced yields are increasingly attracted to the MIC sector.

MICs operate by distributing profits to their shareholders based on their respective ownership stakes. The underlying assets securing the investments consist of real property, though additional forms of security such as personal and corporate guarantees, general security agreements, and assignments of material contracts may complement the collateral.

Investing in a MIC involves owning shares in a company that oversees a diversified portfolio of secured mortgages. These shares qualify as investments under the Income Tax Act 130.1 (Canada), thus eligible for inclusion in registered accounts such as RRSPs, RRIFs, TFSAs, RESPs, and others, providing tax advantages for investors.

The Canadian residential mortgage market was estimated to have $2.0 trillion in principal outstanding. Of this, MIC's represent just 1.65% ($32.9 billion) of mortgage lending. The majority is held by the large banks and credit unions (93.5% as of Q4, 2023), while dedicated Mortgage Finance Corporations make up the balance (4.65%).

There are a number of advantages with HRU:

Unlike publicly traded stocks or mutual funds, NAVPS (Net Asset Value Per Share) of the MIC does not fluctuate in response to market trends. Unless HRU MIC experiences an operating loss, the share values are always equivalent to the share issue price. This is because of the Income Tax Act (ITA) rule requiring 100% of a MIC's net income to be paid out to the shareholders by way of dividends.

Secondly, HRU MIC share values are a function of the quality of mortgage portfolio. Real estate values are much less volatile than stock and bond prices. Even if the borrower defaults, the mortgage investor is protected by a collateral asset that is stable and immoveable, and risk is spread across the entire pool of investments.

MICs offer advantages over traditional banks and lenders because they have more flexible lending guidelines. MICs can offer individually-structured, tailor-made loans to meet the specific requirements of a borrower. In addition, banks have lengthy due diligence processes (up to 2 months) and are typically not able to meet some borrowers’ quick capital needs. Most MICs are typically able to structure, complete due diligence and fund loans within 2 - 4 weeks.

In return for this flexibility, non-bank lenders such as MICs, can charge higher interest rates on their loans (5% - 15% p.a. in the current environment).

Our business model is very similar to the traditional banks. We are considered a balance sheet lender in which we accumulate assets in fixed-term interest-based investments, and lend out mortgages to residential borrowers. The collected monthly mortgage interest is paid to our investors as monthly interest return (similar to a saving accounts).

Mortgage Investment Corporations have a special tax status. The Canada Revenue Agency will deem your income from HRU MIC to be interest income and tax it accordingly; T5 slips are issued at the end of each calendar year.

Foreign Investors will be subject to a withholding tax dependant on the tax treaties between Canada and the Investor's Resident Country. For example, Hong Kong has a Maximum 10% Tax Rate and Cayman Island has 0% Tax Rate.

The main difference between a first (Senior) and second (Subordinated) mortgage is debt seniority. A second mortgage is not "worse" than a first mortgage, it is simply the position it occupies in terms of "which mortgage gets paid first". A Home-Equity Line of Credit (HELOC), for example, is often a second mortgage if there is still an existing mortgage on the property.

From a lender's perspective, in the event of a default, both first and second mortgagees have the right to foreclose on the property and sell it on the market for repayment. However, the first mortgagee is at the first position to get the proceeds; and the second mortgagee will be entitled to the remaining amount. Since second mortgages are behind (subordinate to) the first mortgage, they can be considered more risky and therefore demand a higher return.

In today's market, first mortgage interest rates often range from 3-5%, while second mortgage interest rates can be 10% or higher. Since HRU includes higher-rate second mortgages in our portfolio, we can provide our investors with higher returns.

Our Blog

5 Personal Loan Requirements To Know Before Applying

Introduction Typically, applying for a personal loan requires you to submit identification, proof of address and income. It’s essential to verify the specific requirements in advance, as criteria and qualification standards may vary depending on the lender. For instance, lenders might evaluate your credit score, but one might have a higher threshold than the other….

By Carleigh |

7 Common Investing Mistakes to Avoid

Introduction Investing can often be challenging, with no guaranteed profits. Even seasoned professionals with years of experience can make errors. Furthermore, every investor is unique, possessing distinct investment goals, risk tolerances, and levels of knowledge. Nonetheless, there are some universal mistakes all investors should avoid, which we will discuss below. There are 7 common investing…

By Carleigh |

Exploring the Financial Landscape: A Comprehensive Guide to the Person Loans

Introduction Personal loans can be either secured or unsecured. A secured personal loan involves providing collateral as a condition for borrowing. This collateral could be cash assets like a savings account or a certificate of deposit (CD), or a physical asset such as your car or boat. If you fail to repay the loan, the…

By Carleigh |

Five Things to Consider Before Investing

1. Establish Clear Investment Goals It must be borne in mind that the tragedy of life doesn’t lie in not reaching your goal. The tragedy lies in having no goals to reach – Benjamin E. Mays Short-term Goals: These include objectives like buying a car or planning a trip, typically high liquidity and low-risk investments….

By Carleigh |

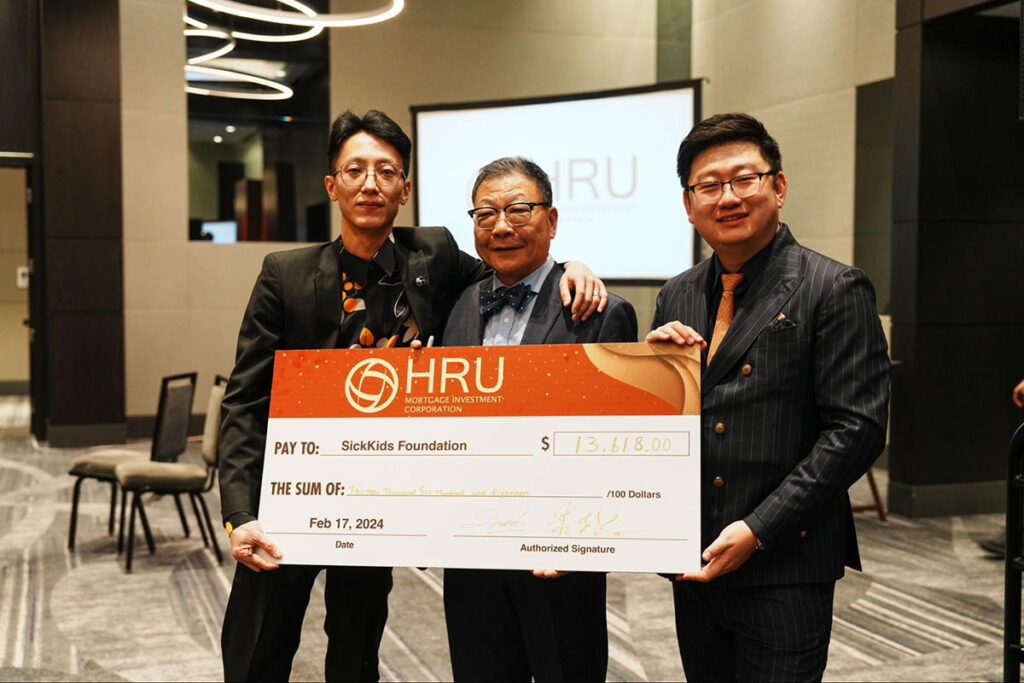

HRU in the Community; past, present and future

Introduction Corporate social responsibility (CSR) is a fundamental aspect of HRU’s ethos, demonstrated through our active participation in a variety of impactful events and initiatives over the years. From supporting community health to empowering youth and promoting the arts, we are dedicated to making a positive difference. These events highlight our significant contributions to various…

By Carleigh |

Long-Term goal: Integrating ESG Considerations into our Practices

On February 17th, 2024, our Annual Charity Dinner was held in collaboration with RBC, Chartered Finance, and The SickKids Foundation.

By Carleigh |

Contact Us

For any inquires, email us or call us.

301-7300 Warden Ave

Markham, Ontario

L3R 9Z6

501 Tower B Gemdale Plaza,

No.91 Jianguo Road,

Chaoyang District, 100020

7/F, Low Block, Grand Millennium Plaza, 181 Queen’s Road Central, Hong Kong Island, Hong Kong

Level 5, Standard Chartered Building

Opp. Emaar Square, Dubai, UAE 35482