5 Personal Loan Requirements To Know Before Applying

Posted On

Share this post

Introduction

Typically, applying for a personal loan requires you to submit identification, proof of address and income. It’s essential to verify the specific requirements in advance, as criteria and qualification standards may vary depending on the lender.

For instance, lenders might evaluate your credit score, but one might have a higher threshold than the other. Some additional common requirements they might consider include:

- Credit history

- Income

- Debt-to-income ratio

- Collateral

- Origination fee

5 Personal Loan Requirements to Know Before Applying

1.Credit Score and History

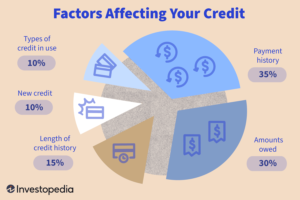

A lender heavily considers an applicant’s credit score when reviewing a loan application. Credit scores range from 300 to 900 and are influenced by factors such as: payment history, outstanding debt, and credit history length. While many lenders require a minimum score of about 600 to qualify, some are willing to extend loans to applicants with no credit history at all.

You don’t need a perfect credit score to obtain a personal loan, but lenders typically view individuals with credit scores of 660 or higher as lower risk.

“A credit score is nothing but an “I love debt” score. It’s proof that you’ve borrowed money and paid it back, so that you can borrow more money and pay THAT back.” ——Dave Ramsey

2.Income

Lenders set income requirements for borrowers to confirm they can repay the loan. These requirements differ by lender: some mandate a minimum income of $1,800 per month, others require at least $13,000 per year, and some evaluate income on a case-by-case basis. Proof of income can include recent tax returns, monthly bank statements, pay stubs, and signed letters from employers. Self-employed applicants can provide tax returns or bank deposits.

3.Debt-to-income Ratio

The debt-to-income ratio (DTI), shown as a percentage, indicates the proportion of a borrower’s gross monthly income used for monthly debt payments. Lenders use DTI to gauge a borrower’s capacity to handle new and existing debt. A higher DTI suggests greater risk to lenders. Different lenders have varying DTI requirements, but credit.org states that most consider a DTI below 36 percent as ‘ideal,’ while 37 to 42 percent is viewed as ‘acceptable.’

Generally, a DTI of 50 percent or more makes loan approval challenging with most lenders.

If your DTI is between 36 and 49 percent but exceeds 43 percent, it might be wise to reduce some of your debt before applying for another loan.

To determine your debt-to-income ratio, sum up your monthly debt payments and your gross monthly income, then divide the total debt by the gross income.

4.Collateral

Collateralization involves using a valuable asset as security for a loan. If the borrower fails to repay the loan, the lender has the right to take and sell the asset to recover their loss.

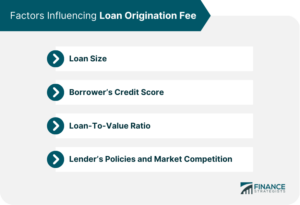

5.Origination fee

An origination fee, generally between 0.5% and 1% of the loan amount, is charged by lenders to cover the cost of processing a loan application. Although these fees can sometimes be negotiated, lowering or avoiding them often results in a higher interest rate over the loan’s duration. The fee rate depends on factors such as the applicant’s credit score and loan amount. Some lenders require origination fees to be paid in cash at closing, while others either include them in the loan amount or deduct them from the total loan disbursement at closing.

4 Personal Loan Documents Your Lender May Require

1.Loan Application

2.Proof of Identity

- Driver’s license

- Social insurance number (SIN)

- Other provincial photo ID

- Passport

- Certificate of citizenship

- Birth certificate

- Military ID

- Provincial medical card with a photo

- proof of address

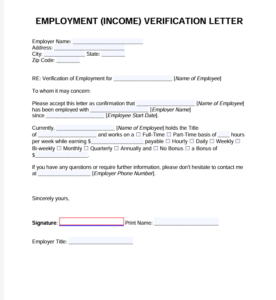

3.Employer and Income Verification

- Paystubs

- tax returns

- CRA Notice of Assessment

- T4s

- Bank statements

- Employer contact information

- Income verification letter from your current employer

4.Proof of Address

- a recent utility bill

- a copy of your lease or other rental agreement,

- voter registration notice or proof of home, rental or auto insurance that lists your address.

Share this post

Related Posts

5 Personal Loan Requirements To Know Before Applying

Introduction Typically, applying for a personal loan requires you to submit identification, proof of address and income. It’s essential to verify the specific requirements in advance, as criteria and qualification standards may vary depending on the lender. For instance, lenders might evaluate your credit score, but one might have a higher threshold than the other….

By Carleigh |

7 Common Investing Mistakes to Avoid

Introduction Investing can often be challenging, with no guaranteed profits. Even seasoned professionals with years of experience can make errors. Furthermore, every investor is unique, possessing distinct investment goals, risk tolerances, and levels of knowledge. Nonetheless, there are some universal mistakes all investors should avoid, which we will discuss below. There are 7 common investing…

By Carleigh |

Exploring the Financial Landscape: A Comprehensive Guide to the Person Loans

Introduction Personal loans can be either secured or unsecured. A secured personal loan involves providing collateral as a condition for borrowing. This collateral could be cash assets like a savings account or a certificate of deposit (CD), or a physical asset such as your car or boat. If you fail to repay the loan, the…