Five Things to Consider Before Investing

Posted On

Share this post

1. Establish Clear Investment Goals

It must be borne in mind that the tragedy of life doesn’t lie in not reaching your goal. The tragedy lies in having no goals to reach – Benjamin E. Mays

- Short-term Goals: These include objectives like buying a car or planning a trip, typically high liquidity and low-risk investments.

- Midterm Goals: Goals such as funding for education or saving for a down payment; suitable for moderate-risk and moderate-return investments.

- Long-term Goals: Planning for retirement savings or wealth accumulation; suitable for long-term investments with high-risk and high-return potential. For example, are you looking to retire in 20 years at age 55? How much money is needed to do this? You must first ask yourself these kinds of questions.

Suggestion: The initial step for a new investor is to identify their investment goals. Ask yourself, “Why am I investing?” Are you preparing for retirement? Saving for a house? Understanding your objectives will steer your investment choices. Next, decide on your investment vehicles, whether it’s buying stocks, investing in ETFs or mutual funds, or setting up a retirement account. Additionally, consider the amount you want to invest and your investment time frame.

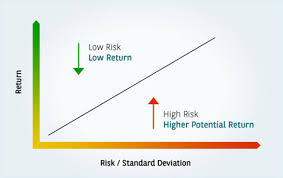

2. Assess Investment Risks

- High Risk:

o High Volatility: Prices can fluctuate significantly, leading to potential short-term gains or losses. Examples include stocks and cryptocurrencies.

o High Potential Returns: Investments like growth tech stocks and emerging markets can yield high returns but also carry a significant risk of loss.

o Low Liquidity: Investments such as venture capital and real estate can be challenging to convert to cash quickly.

- Medium Risk:

o Moderate Volatility: Prices are relatively stable over the long term but may still fluctuate in the short term. Examples include large-cap stocks and balanced funds.

o Moderate Return Potential: Investments like high-quality corporate bonds and dividend stocks offer moderate returns.

o Good Liquidity: Assets such as large-cap stocks and ETFs are relatively easy to convert to cash.

- Low Risk:

o Low Volatility: Assets like government bonds and short-term treasury bills have minimal price fluctuations.

o Stable Returns: Fixed deposits and savings accounts offer predictable, though generally lower, returns.

o High Liquidity: Assets like money market funds and short-term government bonds can be quickly converted to cash.

Suggestions: Most successful investors start with low risk diversified portfolios and gradually learn by doing. As investors gain greater knowledge over time, they become better suited to taking a more active stance in their portfolios.

3. Consider Investment Holding Periods

- Short-term Investments: Holding period of a few days to months, suitable for quick liquidity needs.

- Mid-term Investments: Holding period of one to five years, balancing liquidity with moderate risk and returns.

- Long-term Investments: Holding period of five years or more, aiming for higher returns and risk diversification over time.

Suggestions: Following a well-planned, long-term investment strategy might not be thrilling or exciting. Nevertheless, if you stick to this strategy and avoid letting emotions (referred to as “false friends”) influence your decisions, your likelihood of achieving success in investing is likely to increase

4. Understand Investment Types

- Physical Assets:

o Real Estate: Includes residential and commercial properties, offering potential for capital appreciation and rental income.

o Precious Metals: Such as gold and silver, acting as a hedge against inflation and performing well during economic uncertainty.

o Energy Assets: Includes resources like oil and natural gas, linked to global economic activity but subject to price volatility and geopolitical risks.

- Virtual Assets:

o Cryptocurrencies: Digital currencies like Bitcoin and Ethereum, offering high liquidity and potential returns but with significant volatility and security risks.

o Tokens: Digital representations of rights or usage, with high flexibility and liquidity but regulatory uncertainty.

Suggestions: You don’t need a large sum of money to begin investing, you can start with whatever amount you have. Diversifying across several types of investments can help manage risk and achieve a balanced portfolio.

5.Ensure Legal and Compliance Awareness

- Understand and comply with local laws and regulations to avoid illegal or fraudulent investments.

- Fully comprehend the nature, expected returns, and potential risks of investment products.

- Choose transparent and reliable investment products to mitigate risks.

Suggestion: Read books or take an investment course that deals with modern financial ideas.

The way to get started is to quit talking and begin doing – Walt Disney

Share this post

Related Posts

5 Personal Loan Requirements To Know Before Applying

Introduction Typically, applying for a personal loan requires you to submit identification, proof of address and income. It’s essential to verify the specific requirements in advance, as criteria and qualification standards may vary depending on the lender. For instance, lenders might evaluate your credit score, but one might have a higher threshold than the other….

By Carleigh |

7 Common Investing Mistakes to Avoid

Introduction Investing can often be challenging, with no guaranteed profits. Even seasoned professionals with years of experience can make errors. Furthermore, every investor is unique, possessing distinct investment goals, risk tolerances, and levels of knowledge. Nonetheless, there are some universal mistakes all investors should avoid, which we will discuss below. There are 7 common investing…

By Carleigh |

Exploring the Financial Landscape: A Comprehensive Guide to the Person Loans

Introduction Personal loans can be either secured or unsecured. A secured personal loan involves providing collateral as a condition for borrowing. This collateral could be cash assets like a savings account or a certificate of deposit (CD), or a physical asset such as your car or boat. If you fail to repay the loan, the…